PM SVANidhi Yojana launched on 1 June 2020 by Central government to provide short term loans to street vendors (rehdi / patri valas / phereewala). This scheme has now been restarted as new version with PM SVANidhi Scheme and applications invitation started. The PM svanidhi Login is available to everyone who is a beneficiary of the scheme.

PMSvanidhi Yojana applications can also be made offline at banks or Common Service Centers to avail a loan. The Central Government has recently decided to extend the loan period for Pradhan Mantri Street Vendor AtmaNirbhar Nidhi Yojana. All the important information about this portal will be given here.

Table of Contents

PM SVANidhi Yojana

PM SVANidhi is a Central Sector Scheme (CSS) of the central government, launched to help street vendors. It is a micro-credit scheme, launched by the Ministry of Housing and Urban Affairs in 2020. The scheme facilitates a working capital collateral-free loan of ₹10,000, with subsequent loans of ₹20,000 and ₹50,000 with a 7% interest subsidy.

PM SVANidhi Scheme was launched on 1st June 2020 by the Ministry of Housing and Urban Affairs to provide financial support to street vendors. In August 2025, the Union Cabinet approved for the revamp of this scheme and enhanced loan limits.

Type of Login Under PM SVANidhi

These are the types of Login facilities for the beneficiaries

- Applicant login

- Lender Login

- DPA Ministry

- States

- ULB’s City

- Nodal Officer

- Socio-Economic Profiling

- IEC Material

Extension of PM Svanidhi Yojana till Dec 2030

The central government has decided to continue the Pradhan Mantri Street Vendors Atma Nirbhar Nidhi scheme till the year 2030. Through this scheme, affordable loans without any collateral are being made available to street vendors. This will help increase employment and eliminate unemployment. Under PM Svanidhi, subsidized loans are being provided to street vendors without collateral.

Rate of Interest

The interest charged by the lending institution is determined by the institution as per RBI guidelines. Street vendors who avail of WC loan under the scheme can get an interest subsidy at 7%. The interest subsidy amount is credited to the borrower’s account quarterly.

PM SVANidhi Scheme Eligibility

The applicants must meet certain eligibility criteria in order to be eligible for applying Svanidhi scheme. This scheme is available to every street vendor working in urban areas. Vegetables, fruits, ready-to-eat street food, tea, pakodas, breads, eggs, textile, artisan products sellers are among others who are considered eligible under the PM SVANidhi Yojana.

PM Svanidhi Yojana Loan Amount

Any street vendor can apply for the following loan amount under Svanidhi Scheme:-

- Rs. 15,000 Loan (First Term Loan) – For this, click “Apply 15K Loan” at the official website.

- Rs. 25,000 Loan (Second Term Loan) – For this, click “Apply 25K Loan” at the official website.

- Rs. 50,000 Loan (Third Term Loan) – For this, click “Apply 50K Loan” at the official website.

Street Vendors Scheme – State Wise Guidelines

| State/UT | SV Rules | SV Scheme |

|---|---|---|

| Andaman & Nicobar Islands | Download | Download |

| Andhra Pradesh | Download | Download |

| Arunachal Pradesh | Download | Download |

| Assam | Download | Download |

| Bihar | Download | Download |

| Chandigarh | Download | Download |

| Chhattisgarh | Download | Download |

| Dadra & Nagar Haveli | Download | Download |

| Daman & Diu | Download | Download |

| Delhi | Download | Download |

| Goa | Download | Download |

| Gujarat | Download | Download |

| Haryana | Download | Download |

| Himachal Pradesh | Download | Download |

| Jharkhand | Download | Download |

| Karnataka | Download | Download |

| Kerala | Download | Download |

| Madhya Pradesh | Download | Download |

| Maharashtra | Download | Download |

| Manipur | Download | Download |

| Meghalaya | Download | Download |

| Mizoram | Download | Download |

| Nagaland | Download | Download |

| Odisha | Download | Download |

| Puducherry | Download | Download |

| Punjab | Download | Download |

| Rajasthan | Download | Download |

| Tamil Nadu | Download | Download |

| Telangana | Download | Download |

| Tripura | Download | Download |

| Uttar Pradesh | Download | Download |

| Uttarakhand | Download | Download |

| West Bengal | Download | Download |

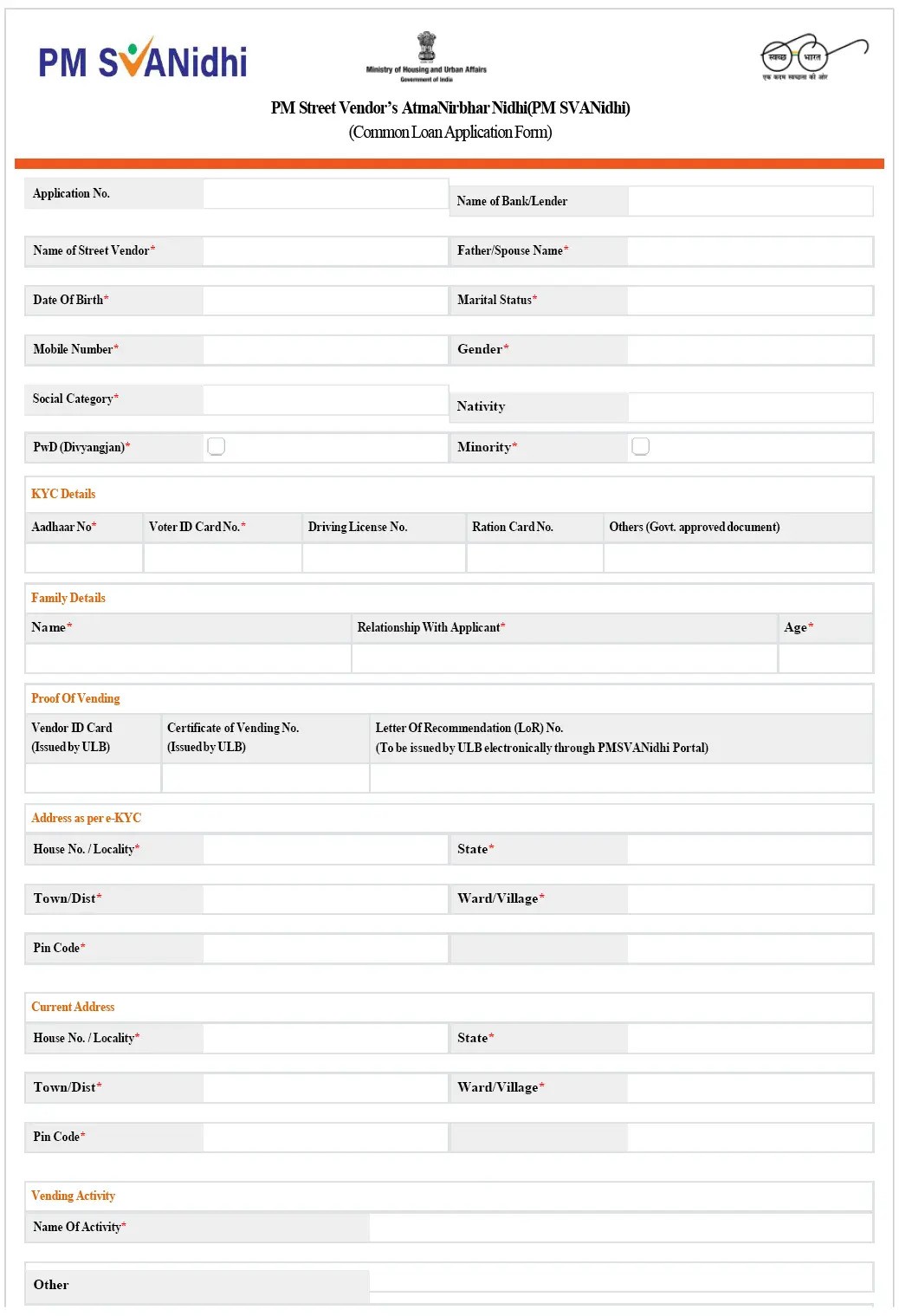

PM Svanidhi Loan Application Form PDF

To download the Svanidhi Scheme loan application form in PDF format, visit the official PM Svanidhi Scheme portal at http://pmsvanidhi.mohua.gov.in/. Here, go to the “Scheme to Apply for a Loan” section. You can download the application form in PDF format.

PM Svanidhi Application Form PDF: Download Now

PM Swanidhi Scheme Application Process

The apply online process for street vendor scheme has started again. Applicants can follow the simple steps given below to apply for the Svanidhi Scheme:

Step 1: Visit the official website pmsvanidhi.mohua.gov.in.

Step 2: On the homepage, click the “Login” button and select ‘Applicant’.

Step 3: You will be redirected to the login portal.

Step 4: Enter your mobile number and captcha and generate an OTP.

Step 5: After logging in, select the vendor category and enter the Survey Reference Number (SRN).

Step 6: Now fill in all the required information.

Under the scheme, loans are being provided by scheduled commercial banks, regional rural banks, small finance banks, cooperative banks, non-banking finance companies, micro finance institutions and SHG banks. Eligible citizens can apply for this both online and offline.

PM Svanidhi Mobile App Download Link for Android Users

The Ministry of Housing & Urban Affairs has already launched the http://pmsvanidhi.mohua.gov.in/ website and also launched mobile app. The official PM Svanidhi App download from google play store for android users.

The direct link to download PM Svanidhi Mobile App from Google Play Store is given here – https://play.google.com/store/apps/details?id=com.mohua.pmsvanidhi&hl=en_IN&gl=US

PM SVANidhi Mobile Application provides end-to-end solution to facilitate Lending Institutions – Banks/ NBFCs/ MFIs etc. to process loan applications of beneficiaries through their field agents.

Features of PM SVANidhi App

The PM SVANidhi App has the features which are described below:-

- Vendor search in the survey data

- E-KYC of applicants

- Processing of Loan applications

- Real-time monitoring

If you want to get information about the PMSvanidhi Yojana or apply online, you can do so through the app. Additionally, your driving license, MNREGA card, and PAN card are also included in the KYC documents. The scheme provides financial stability to street vendors and helps them to become self-reliant.

FAQs

What is the PM SVANidhi scheme?

PM SVANidhi is a central-sector micro-credit scheme launched by the Ministry of Housing and Urban Affairs (MoHUA) to provide handholding support to street vendors.

How to check PM SVANidhi EMI status?

You can check the PM SVANidhi EMI status by visiting the PM SVANidhi website, click on ‘Know Your Application Status’, enter your application number to view the PM SVANidhi status.

What is the interest rate of the PM SVANidhi scheme?

The PM SVANidhi scheme provides an interest subsidy of 7% per annum on timely repayment of EMIs for collateral-free loans.

He is a professional blogger, blogging expert, SEO strategist, and founder of Latestsarlariyojana.com. With over 10+ years in the industry, he helps creators and entrepreneurs build successful websites and blogs.