PM Vidya Lakshmi Portal started by the Government of India to provide collateral-free, guarantor-free education loans to meritorious students pursuing higher studies. All the students of the country can now get higher education without worrying about money by taking education loan. For this, an online portal has also been started by the Central Government. Vidya Lakshmi Portal aims to make the loan process easy for students.

Vidya Lakshmi Portal Registration and Login process has been started by central government. Students can view, apply and track the education loan applications to banks anytime, anywhere by accessing the Vidyalaxmi Portal.

Table of Contents

PM Vidya Lakshmi Portal

PM-Vidyalaxmi is a Unified Portal for the students to apply for education loan provided by scheduled commercial banks, co-operative banks, RRBs & private banks and submit application for Educational Loan & Interest Subvention. Vidya Laxmi portal is helpful for Indian students who are looking for student loans in India. All the students can now apply online for education loan at the official Vidya Laxmi Portal.

PM-Vidyalaxmi scheme provide students a centralized portal to apply for loans from multiple banks. There are details of 86 education loan schemes offered by 38 Indian banks on the Vidya Laxmi Portal. On this education loan portal, students can compare public Vs private education loan providers to select the best one for them.

PM SVANidhi Yojana Online Registration

What Makes the PM Vidya Lakshmi Portal Useful?

| Feature | Purpose |

| Single-window loan access | Apply for multiple education loans from over 40 banks via one platform |

| Centralised application process | Submit one common loan form to up to three banks |

| Integration with NSP | Portal connects to the National Scholarship Portal for smoother fund access |

| Loan tracking dashboard | Track application status and bank replies in real-time |

PM Vidyalaxmi Scheme Documents Required

- Identity Proof: Aadhaar card (mandatory), PAN card, passport.

- Proof of Admission: Admission letter, course details, and fee structure.

- Academic Records: Class 10/12 mark sheets, entrance exam scorecard (e.g., JEE, NEET, CLAT).

- Income Proof: Income certificate issued by a competent authority, ITR.

- Bank Details: Account number, IFSC code, cancelled cheque, or passbook copy.

- Other Documents: Passport-sized photographs, proof of residence, fee receipt, or bank-specific documents.

PM Vidya Lakshmi Portal Registration

Vidya Lakshmi Portal provides single window for Students to access information about various education loan schemes provided by banks. If you want to apply for education loan, you must register on portal. Here is the complete process to make PM Vidya Lakshmi Portal Registration.

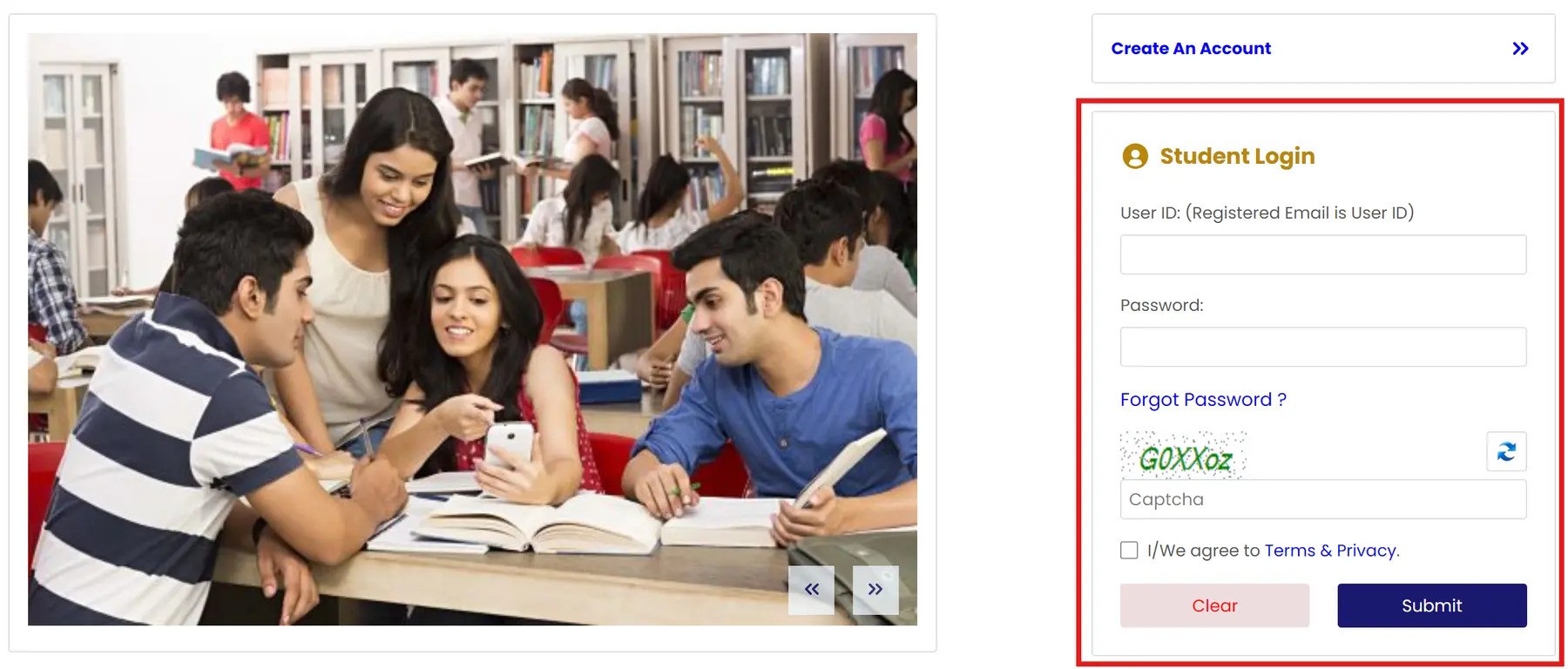

STEP 1: Firstly visit the official website at https://pmvidyalaxmi.co.in and click on the “Student Login” on the homepage.

STEP 2: On the next page, click on “Create An Account” tab as shown below:

STEP 3: Direct Link to student registration page – https://pmvidyalaxmi.co.in/StudentSignUp.aspx

STEP 4: Then the Vidya Lakshmi Portal registration form online will appear.

STEP 5: Fill in all the details to complete Vidya Lakshmi Portal registration process and proceed to Login page.

PM Vidyalaxmi Portal Login

Interested students who wants to apply online for education loan can now make Vidyalaxmi Portal. The direct link to make PM Vidya Laxmi portal login is https://pmvidyalaxmi.co.in/StudentLogin.aspx. Through this, students can login and get information related to the loan and can also apply.

To log in to the portal, students must have a user ID and password. After that, they can fill out the Vidyalakshmi Education Loan application form by clicking on the provided link.

List of Registered Banks for Education Loan

There are a total of 48 banks registered banks at Vidya Lakshmi Portal. All these banks provide education loans to students at affordable rates which are completely collateral and guarantor-free. Here is the list of banks registered on the portal of Vidya Laxmi.

Private Sector Banks

| 1 | Dhanlaxmi Bank |

| 2 | HDFC Bank Ltd |

| 3 | ICICI Bank |

| 4 | IDBI Bank Ltd |

| 5 | Jammu & Kashmir Bank |

| 6 | Karnataka Bank Ltd. |

| 7 | RBL BANK LIMITED |

| 8 | Tamilnad Mercantile Bank Ltd. |

| 9 | The Karur Vysya Bank Limited |

| 10 | The Nainital Bank Limited |

| 11 | The South Indian Bank Ltd. |

Public Sector Banks

| 1 | Bank of Baroda |

| 2 | Bank Of India |

| 3 | Bank of Maharashtra |

| 4 | Canara Bank |

| 5 | Central Bank Of India |

| 6 | Indian Bank |

| 7 | Indian Overseas Bank |

| 8 | Punjab & Sind Bank |

| 9 | Punjab National Bank |

| 10 | State Bank of India |

| 11 | UCO Bank |

| 12 | Union Bank Of India |

Regional Rural Bank

| 1 | ANDHRA PRADESH GRAMEENA VIKAS BANK |

| 2 | Andhra Pragathi Grameena Bank |

| 3 | Aryavart Bank |

| 4 | BARODA GUJARAT GRAMIN BANK |

| 5 | Baroda U.P Bank ( Kashi Gomti Samyut Gramin ) |

| 6 | Chaitanya Godavari Grameena Bank |

| 7 | Chhattisgarh Rajya Gramin Bank |

| 8 | Himachal Pradesh Gramin Bank |

| 9 | JHARKHAND RAJYA GRAMIN BANK |

| 10 | KARNATAKA VIKAS GRAMEENA BANK |

| 11 | Kerala Gramin Bank |

| 12 | Maharashtra Gramin Bank |

| 13 | Meghalaya Rural Bank |

| 14 | Prathama UP Gramin Bank |

| 15 | Puduvai Bharathiar Grama Bank |

| 16 | Punjab Gramin Bank |

| 17 | Rajasthan Gramin Bank |

| 18 | Rajasthan Marudhara Gramin Bank |

| 19 | Saptagiri Grameena Bank |

| 20 | Sarva Haryana Gramin Bank |

| 21 | Saurashtra Gramin Bank |

| 22 | TAMILNADU GRAMA BANK |

| 23 | Telangana Grameena Bank |

| 24 | Tripura Gramin Bank |

| 25 | UTTARAKHAND GRAMIN BANK |

| 26 | Uttarbanga Kshetriya Gramin Bank |

Under this scheme, students can avail collateral free and guarantor free education loans. Vidya Lakshmi loan approval time ranges from 15 to 30 working days, depending on your profile and documents. The scheme supports over 22 lakh students annually by providing collateral-free, guarantor-free education loans.

This portal is supported by the Government of India under the Government Guarantee Cover Scheme for Indian Banks. If a student takes out a loan of up to ₹7.5 lakh for their studies and is unable to repay it, the government reimburses the amount.

He is a professional blogger, blogging expert, SEO strategist, and founder of Latestsarlariyojana.com. With over 10+ years in the industry, he helps creators and entrepreneurs build successful websites and blogs.