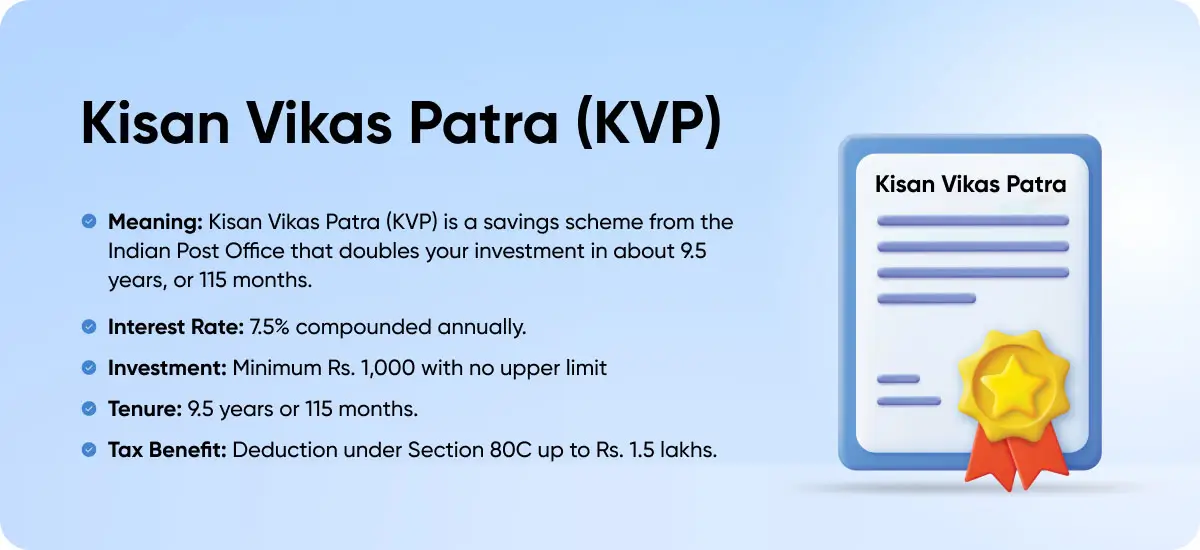

Kisan Vikas Patra (KVP) is a savings scheme available in post offices across India. This initiative by the Indian government promotes small savings for a secure financial future. A minimum of Rs.1000, and any sum in multiples of Rs.100 is to be deposited for opening a KVP account, with no maximum investment limit. Kisan Vikas Patra interest rate is 7.5% compounded annually.

Kisan Vikas Patra (KVP) Introduced in 1988 by the Indian Post for encourages small savings over the long term among the masses for securing their future. It is a risk-free investment option for long-term savings. It is a low-risk savings platform where you can safely park your money for a certain period. In this post, we will tell you KVP Interest Rate, Calculator, Online Purchase, Withdrawal Rules, Lock in Period & Tax Benefits.

What is Kisan Vikas Patra?

India Post introduced the Kisan Vikas Patra (KVP) as a small saving scheme. These schemes cater to various financial goals, such as retirement, education, and emergency funds. The minimum investment amount is Rs.1,000, and there is no upper limit. The tenure for the scheme is now 115 months (9 years and 5 months). Initially, KVP was launched for Indian farmers but can be availed by all now. KVP is like that piggy bank for grown-ups.

Types of KVP Certificates

Kisan Vikas Patra instrument is fixed by govt. and candidates can purchase it through cash / cheque / pay order / demand draft. Indian Residents can only invest and purchase KVP certificates and NRI cannot invest in KVP certificate.

- Single Holder Certificate – Issued to an eligible individual for self/behalf of a minor/minor.

- Joint ‘A’ Certificate – Issued to two eligible individuals, payable to both holders jointly or survivors.

- Joint ‘B’ Certificate – Issued jointly to two eligible individuals, payable to either of the joint holders or the survivors.

Balika Samridhi Yojana: Factors, Eligibility, Application Procedure

KVP Interest Rates

The current KVP interest chart and that for the preceding five financial years are shown below for a better understanding of the interest rates. The KVP interest rate chart for the last few quarters is illustrated in the table below-

| Time Period | KVP Interest Rate |

| Q1 FY 2024-25 | 7.5% |

| Q4 FY 2023-24 | 7.5% |

| Q3 FY 2023-24 | 7.5% |

| Q2 FY 2023-24 | 7.5% |

| Q1 FY 2023-24 | 7.5% |

| Q4 FY 2022-23 | 7.2% |

| Q3 FY 2022-23 | 7.0% |

| Q2 FY 2022-23 | 6.9% |

| Q1 FY 2022-23 | 6.9% |

| Q4 FY 2021-22 | 6.9% |

| Q3 FY 2021-22 | 6.9% |

| Q2 FY 2021-22 | 6.9% |

| Q1 FY 2021-22 | 6.9% |

| Q4 FY 2020-21 | 6.9% |

| Q3 FY 2020-21 | 6.9% |

| Q2 FY 2020-21 | 6.9% |

| Q1 FY 2020-21 | 6.9% |

| Q4 FY 2019-20 | 7.6% |

| Q2 FY 2019–20 | 7.6% |

| Q1 FY 2019–20 | 7.7% |

| Q4 FY 2018-19 | 7.7% |

| Q3 FY 2018-19 | 7.7% |

| Q2 FY 2018-19 | 7.3% |

| Q1 FY 2018-19 | 7.3% |

Documents Required to Get Kisan Vikas Patra Certificate

When you are filling up application for Kisan Vikas Patra (KVP), you have to keep these documents in hand. Listed below are those

- Address proof

- Birth Certificate

- Identity proof, such as Aadhaar Card, Voter ID, PAN, drivers license, passport.

- And duly filled application form for KVP

Eligibility Criteria

The following is the eligibility criteria for investing in the KVP scheme:

- The applicant has to be an adult resident of India.

- The applicant must be above 18 years of age

- A parent/guardian may invest on behalf of a minor.

- A trustee can purchase a KVP certificate.

- Hindu Undivided Families (HUFs) and Non-Resident Indian (NRIs) cannot invest in Kisan Vikas Patra.

How to apply Kisan Vikas Patra Scheme

Step 1: Go to your nearest Post Office branch where the KVP scheme is available.

Step 2: Ask for the KVP application form (Form-A) and fill in the required details such as name, address, investment amount, nominee details, etc.

Step 3: Submit identity proof (Aadhaar, PAN, Voter ID) and address proof.

Step 4: Make the payment either in cash, cheque, or demand draft.

Step 5: You will receive a Kisan Vikas Patra certificate (either physical or electronic), which serves as proof of investment.

Kisan Vikas Patra vs Fixed Deposits

| Parameters | KVP | FD |

| Investments | Minimum investment of Rs.1000 required whereas there is no capping on maximum investment | Minimum- Rs. 500 Maximum- Not Limited |

| Rate of Interest | 7.5% | Differs from bank to bank |

| Maturity | 9 years 7 months (115 months) | 10 years. However, subscribers can withdraw money after 7 days from the date of investment |

| Tax Treatment | Returns on KVP are taxable | Tax saver FDs are tax exempted for up to Rs. 1.5 Lakh under Section 80 (C) |

| Lock-in periods | Lock-in period of 2 and a half years | No lock-in period. The tenure of Fixed deposits ranges from 7 days to 10 years |

| Premature Withdrawals | Withdrawals are allowed before maturity but it is advised to keep the corpus invested for 124 months to get best returns | Money can be withdrawn as and when the subscriber wants, after 7 days |

If you’re searching for a risk-free and government Schemes, the Kisan Vikas Patra Scheme is worth considering. Any Indian citizen above the age of 18 years can buy a Kisan Vikas Patra from the nearest post office.

FAQs

What is the maturity period of KVP?

The maturity period of Kisan Vikas Patra (KVP) is approximately 115 months, which is about 9 years and 5 months.

What are the types of KVP certificates?

Single Holder Type, Joint A Type, and Joint B Type certificates are available, you can read more in the article stated above.

How to transfer KVP Account?

KVP can be transferred from one Post Office to another or from one person to another.

He is a professional blogger, blogging expert, SEO strategist, and founder of Latestsarlariyojana.com. With over 10+ years in the industry, he helps creators and entrepreneurs build successful websites and blogs.